Early Mortgage Payoff Calculator with Excel sheet

Please click here to read the full FTC Affiliate Disclosure policy.

- February 16, 2024 @ 12:16 pm EDT

- comments

When we buy a house, we think we are building equity and not renting. But what few of us realize is that for the first few years, most of what the bank collects from us is interest. Only about 10-15% of what you pay goes to the principal if you pay off on the bank’s schedule for the first 5 years. It’s almost as if you are renting from your mortgage lender. But there IS a way to game the system in your favor – early mortgage payoff! Use an early mortgage payoff calculator (see Excel sheet below or use an online tool as as Karl’s mortgage calculator). Personally, I prefer the Excel.

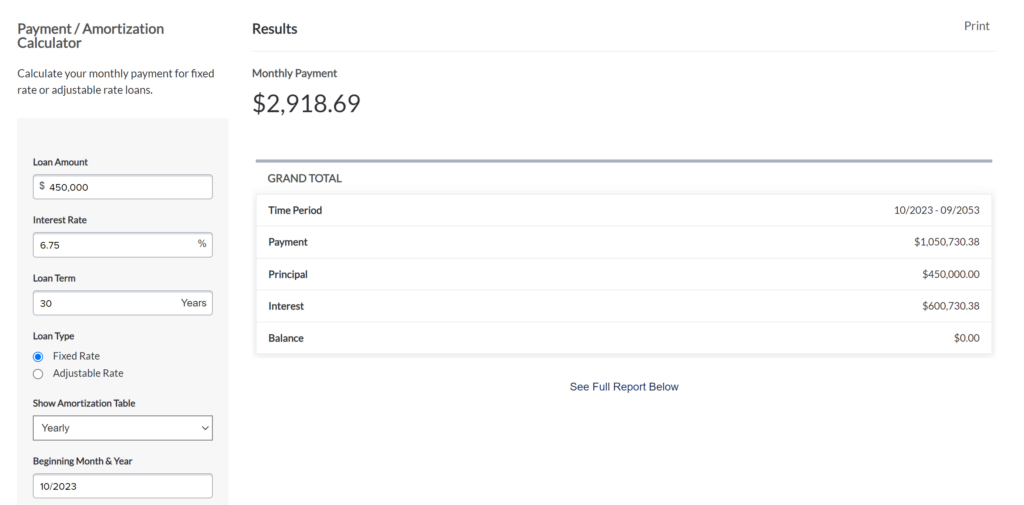

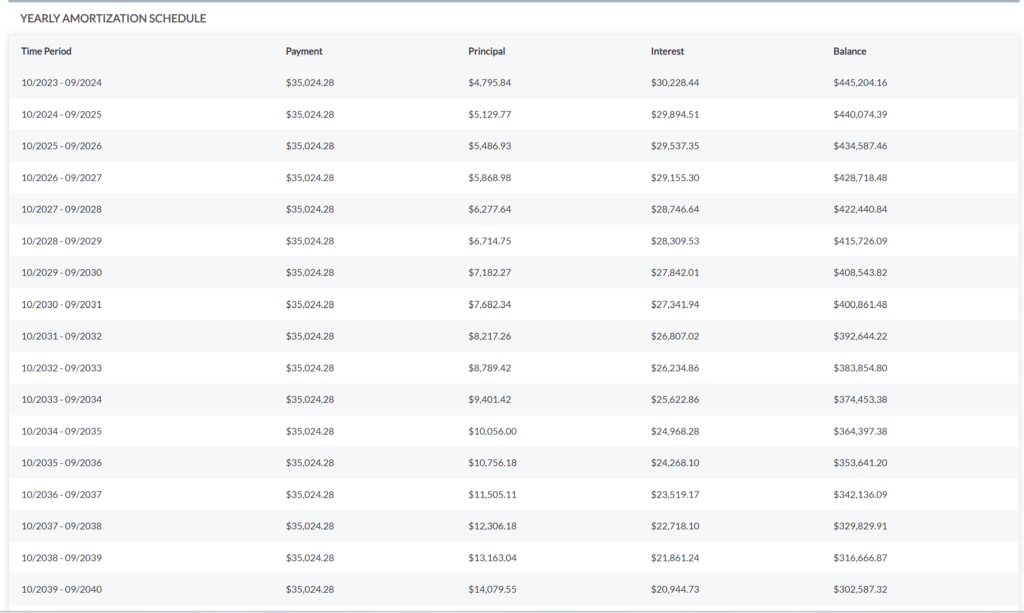

To drive home the point of how much is just given away as interest, here is a calculation for a loan of $450,000 at a 6.75% rate. If you want to try this on your own mortgage, go here. This is how much extra you are spending to buy a house, and the important thing to remember is the bank is going to squeeze it all out of you mostly in the early years. If you do refinance maybe 3-5 years in, you reset your amortization clock, and go back to having everything you pay the bank be interest for another 10 years!!

An easy strategy is using early principal payoffs to shave off a sizable portion of this interest and build equity with the same dollars instead. But how much principal to pay off? This depends on how much disposable income you have, your loan rate, what point in the loan cycle you are, and of course, the stark uncomfortable knowledge of how much interest you are paying every year, as a percentage. Most of us stay blissfully ignorant, so we happily go with the system devised. You need to gain that knowledge first, and then make a personalized decision after. There is no one-size-fits-all solution.

Early Mortgage payoff calculator with Excel sheet

⏩⏩When buying a house, calculate your amortization schedule here.

⏩⏩Using the attached Excel sheet, (see download link below), work out what % of your payoff is going to interest every year. Use that to inform your decisions regarding the Principal payoff.

From my actual amortization schedule, at a rate of 7.35% for a jumbo loan, In the first year, in the very first payment, about 89% of my first mortgage payment would go completely to interest (!!!). But If I paid down the mortgage really aggressively, a correspondingly lower percentage of my next payment would go to interest, and the rest to where it should actually go – the principal.

The lending industry has set this up to be hard and really front-loaded. You see the difference from just paying 4-years-worth of principal payments – your % interest just goes down a little, from 89% to 85% (my actual numbers at a 7.35% interest rate). You need to get to somewhere as late out as year 18 for a much bigger chunk of your monthly payment to actually go toward building equity. If I got to year 4 end in a single bound, in the next payment, only 85% of what I paid would go to interest. If I got to year 18 really fast (maybe even in a single bound if I had the money), in the next payment, only 59% would go to interest.

Strategy: Look into splitting up the monies you have for your down payment – pay as little to get the best rate possible, avoid paying PMI (which is a HUGE racket), and then save the rest to go in after you close, just before or with the first payment. Then pay smaller amounts.

Note: If you have a 2.5% interest rate, it financially does not make sense to put most of your extra cash towards paying down your mortgage, just maybe a smaller amount that is dictated by your finances. But if you are getting a 6-8% rate in this current buying market, it absolutely seems to make sense to do this. No matter where you are, it’s time to do some number-crunching and pick the best personalized option for you!

If you are a first-time visitor to this site and found this useful, know that we don’t just share consumer & health advice, we also share 100s of fantastic deals every day!